Why Loyalty Apps Are a Revenue-Driving Machine

In an era where customer acquisition costs are skyrocketing—rising by 60% over the past five years—businesses must shift their focus from just attracting new customers to maximizing the lifetime value (LTV) of existing ones. Enter loyalty apps: a data-driven, highly personalized tool designed to increase repeat purchases, enhance customer retention, and drive incremental revenue. A well-executed loyalty program can boost revenue by 25-95% and increase purchase frequency by up to 50%.

This article explores how a strategically designed loyalty app can optimize ROI by influencing customer behavior, driving higher spending, and creating brand advocates.

1. Leveraging Data-Driven Personalization to Drive Higher Spend

Modern loyalty apps collect vast amounts of customer data, allowing brands to deliver hyper-personalized experiences. This approach increases purchase frequency and average order value (AOV).

Advanced Strategies:

- AI-Powered Recommendations: Suggest products based on purchase history, increasing basket size.

- Tier-Based Incentives: Higher tiers unlock better rewards, motivating customers to spend more.

- Dynamic Pricing: Offer personalized discounts based on real-time shopping behavior.

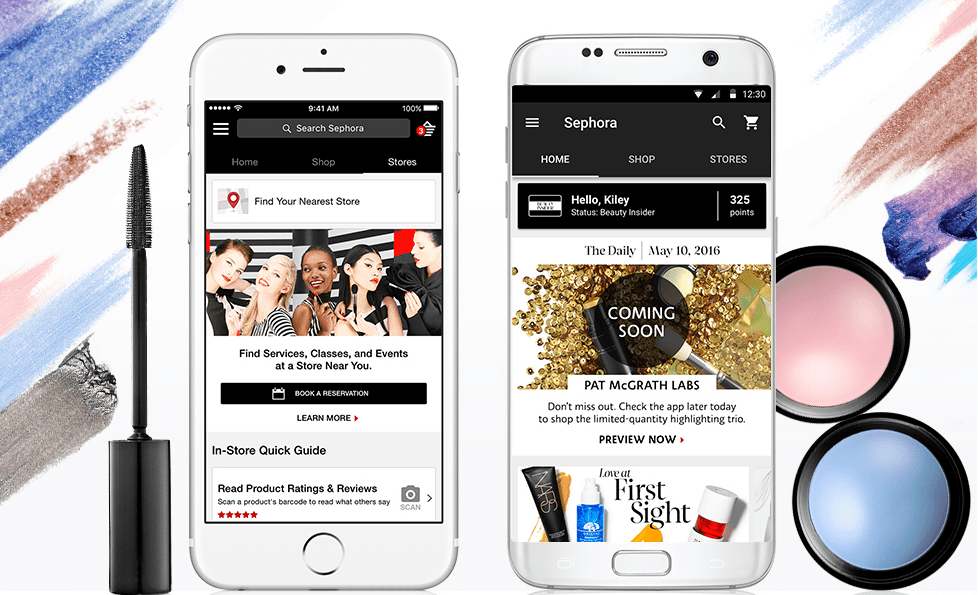

Case Study: Sephora Beauty Insider

Sephora’s loyalty app uses AI-driven personalization to recommend beauty products. Members in higher tiers spend 60% more than non-members, proving the power of personalized engagement.

2. Gamification: Turning Shopping into an Engaging Experience

Gamification triggers dopamine-driven engagement, encouraging customers to return frequently and spend more.

Advanced Strategies:

- Purchase-Based Challenges: Reward users for spending milestones (e.g., “Spend $200 this month to earn a surprise gift”).

- Streak-Based Rewards: Customers earn more points for consecutive purchases, ensuring habitual spending.

- Referral Competitions: Encourage social sharing by offering bonus points for inviting friends.

Case Study: Starbucks Rewards

Starbucks uses gamification to increase customer retention. Their “Bonus Star Challenges” drive double-digit sales growth, proving that interactive incentives significantly impact revenue.

3. Instant Gratification: Encouraging Impulse Purchases

Loyalty apps that offer immediate rewards influence consumer behavior by capitalizing on impulse-driven spending.

Advanced Strategies:

- Instant Cashback: Instead of delayed rewards, provide instant cashback redeemable on the next purchase.

- Limited-Time Flash Offers: Unlock time-sensitive discounts after each transaction to drive urgency.

- In-App Currency: Allow users to accumulate and instantly redeem points at checkout.

Case Study: Amazon Prime Rewards

Amazon’s Prime Rewards system gives 5% cashback on purchases, leading to Prime members spending 133% more annually than non-members.

4. Mobile Wallet Integration for Frictionless Payments and Higher Conversion

A loyalty app that seamlessly integrates with mobile wallets can eliminate payment barriers, making transactions smoother and increasing purchase frequency.

Advanced Strategies:

- One-Tap Loyalty Enrollment: Auto-enroll users in the program through mobile wallets like Apple Pay or Google Pay.

- Card-Linked Offers: Connect credit cards to loyalty programs, ensuring rewards are applied without extra steps.

- AI-Driven Spending Insights: Provide personalized spending breakdowns to encourage smarter, habitual shopping.

Case Study: Walmart Pay

Walmart’s loyalty-linked mobile payments saw a 20% increase in repeat transactions, proving that a frictionless checkout experience increases sales.

5. Predictive Analytics: Forecasting and Influencing Customer Behavior

Harnessing AI and predictive analytics enables businesses to forecast spending trends and proactively influence purchasing decisions.

Advanced Strategies:

- Churn Prediction Models: Identify at-risk customers and send targeted re-engagement offers.

- Dynamic Rewards Adjustments: Adjust offers based on real-time purchasing patterns.

- A/B Testing Loyalty Incentives: Continuously refine rewards structures to maximize ROI.

Case Study: Nike Membership App

Nike’s AI-powered loyalty system predicts when customers are likely to make their next purchase and sends strategic discounts. This has increased repeat purchases by 40%.

6. Community-Driven Loyalty: Transforming Customers into Brand Advocates

Loyalty apps aren’t just about discounts; they should foster a deeper emotional connection with customers by building a community.

Advanced Strategies:

- Exclusive Member-Only Events: Host VIP shopping nights, early product access, or meet-and-greets.

- User-Generated Content (UGC) Rewards: Incentivize customers to share experiences on social media.

- Social Proof-Based Incentives: Offer additional perks for leaving reviews or testimonials.

Case Study: Lululemon Sweat Collective

Lululemon offers loyalty members access to exclusive workouts, increasing retention and making brand advocates out of customers. Members spend 30% more than non-members.

7. The Psychological Triggers Behind Loyalty App Success

Behavioral economics plays a crucial role in customer retention. Loyalty apps use these psychological principles to drive spending:

Key Psychological Triggers:

- Endowed Progress Effect: Customers are more likely to complete a rewards program if they start with “bonus points.”

- Loss Aversion: Time-sensitive rewards make customers feel they’re “losing out” if they don’t redeem them.

- Reciprocity Principle: Offering a free reward upfront increases the likelihood of future purchases.

Case Study: Uber Rewards

Uber’s loyalty program offers an automatic points boost upon joining, leveraging the Endowed Progress Effect to encourage continued engagement.

8. Measuring ROI: How to Quantify Your Loyalty Program’s Impact

To maximize the effectiveness of a loyalty app, brands must track performance using key KPIs.

Critical Metrics to Track:

- Customer Lifetime Value (CLV): Compare CLV of loyalty members vs. non-members.

- Redemption Rate: Track how often rewards are redeemed to gauge engagement levels.

- Repeat Purchase Rate: Measure how frequently customers return after joining the program.

Case Study: Hilton Honors

Hilton measures the CLV of its loyalty members, which is 50% higher than non-members, proving that effective loyalty programs drive tangible financial returns.

Final Thoughts: The Future of Loyalty Apps and ROI Maximization

A loyalty app is no longer just a “nice-to-have”—it’s a critical revenue driver for any brand looking to increase customer retention, lifetime value, and overall profitability. By leveraging personalization, gamification, predictive analytics, and seamless payment integrations, businesses can transform occasional shoppers into high-value brand advocates.

To achieve maximum ROI, companies must continuously optimize their loyalty strategy using real-time data and behavioral insights. The brands that get this right won’t just see incremental gains—they’ll dominate their industry.

Now is the time to revolutionize your loyalty strategy and unlock exponential sales growth. Are you ready?